Mobile Insurance

Experience the convenience and security of TPL Mobile Insurance. For us, it's not just about shielding your device; it's about securing your peace of mind, our coverage offers comprehensive protection against accidents, theft, and screen damage. Trust TPL Mobile Insurance for a seamless and cost-effective solution, ensuring your device stays protected.

Terms & Conditions Apply *

Key Features

Comprehensive mobile insurance coverage that keeps your smartphone protected from everyday risks.

Accidental & Physical Damage

Coverage for accidental and/or physical damage to your mobile phone.

Theft & Armed Holdup

Get your mobile protected against theft and armed holdup with our comprehensive coverage.

Maximum Coverage

Maximum sum insured up to Rs. 100,000/- for your mobile device protection.

What We Covered

Coverage for your mobile device protection needs.

| Features | Coverage |

|---|---|

| Accidental and/or Physical Damage | |

| Theft/Armed holdup of mobile phones | |

| Maximum sum insured – Rs. 100,000/- |

Coverage

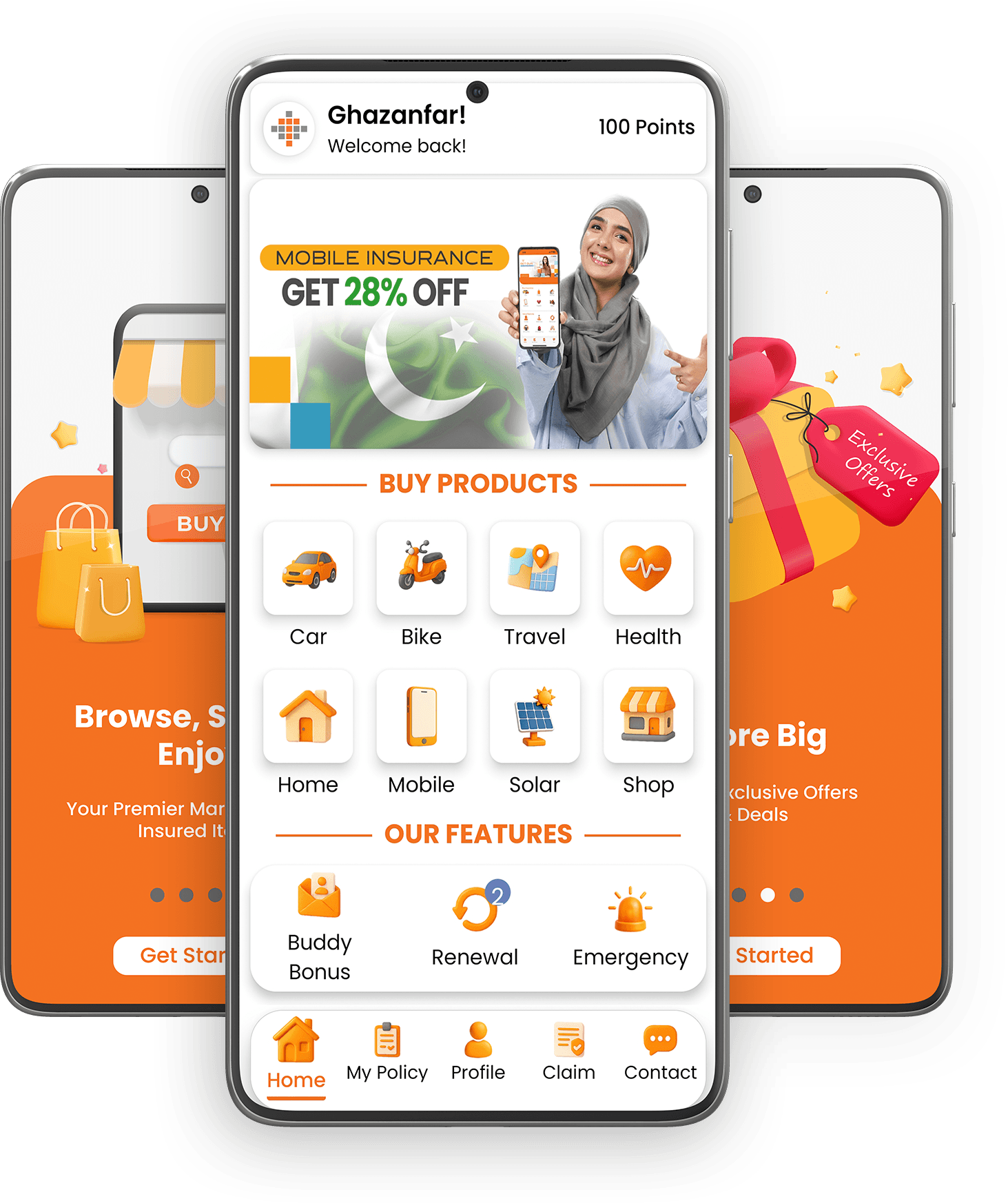

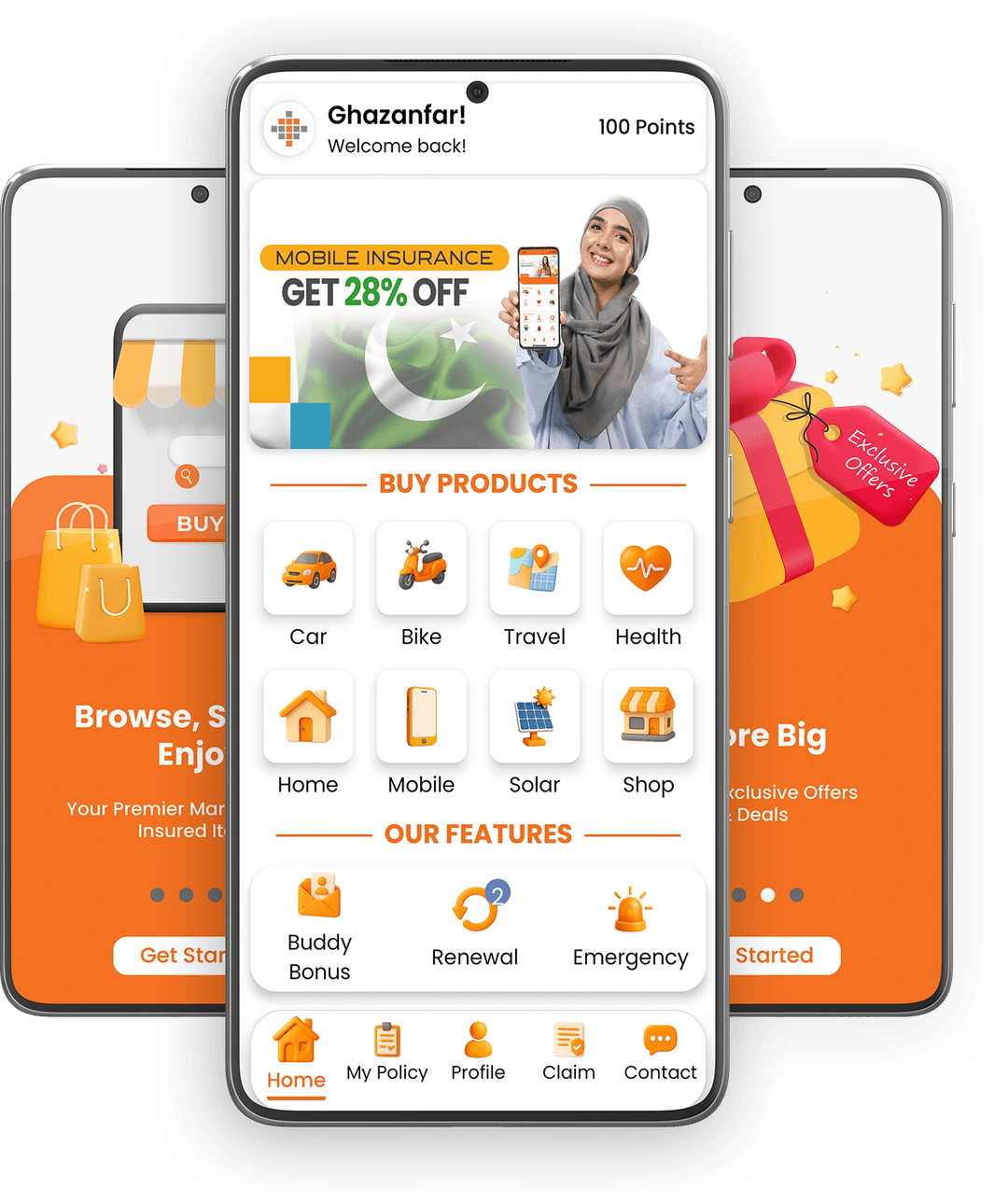

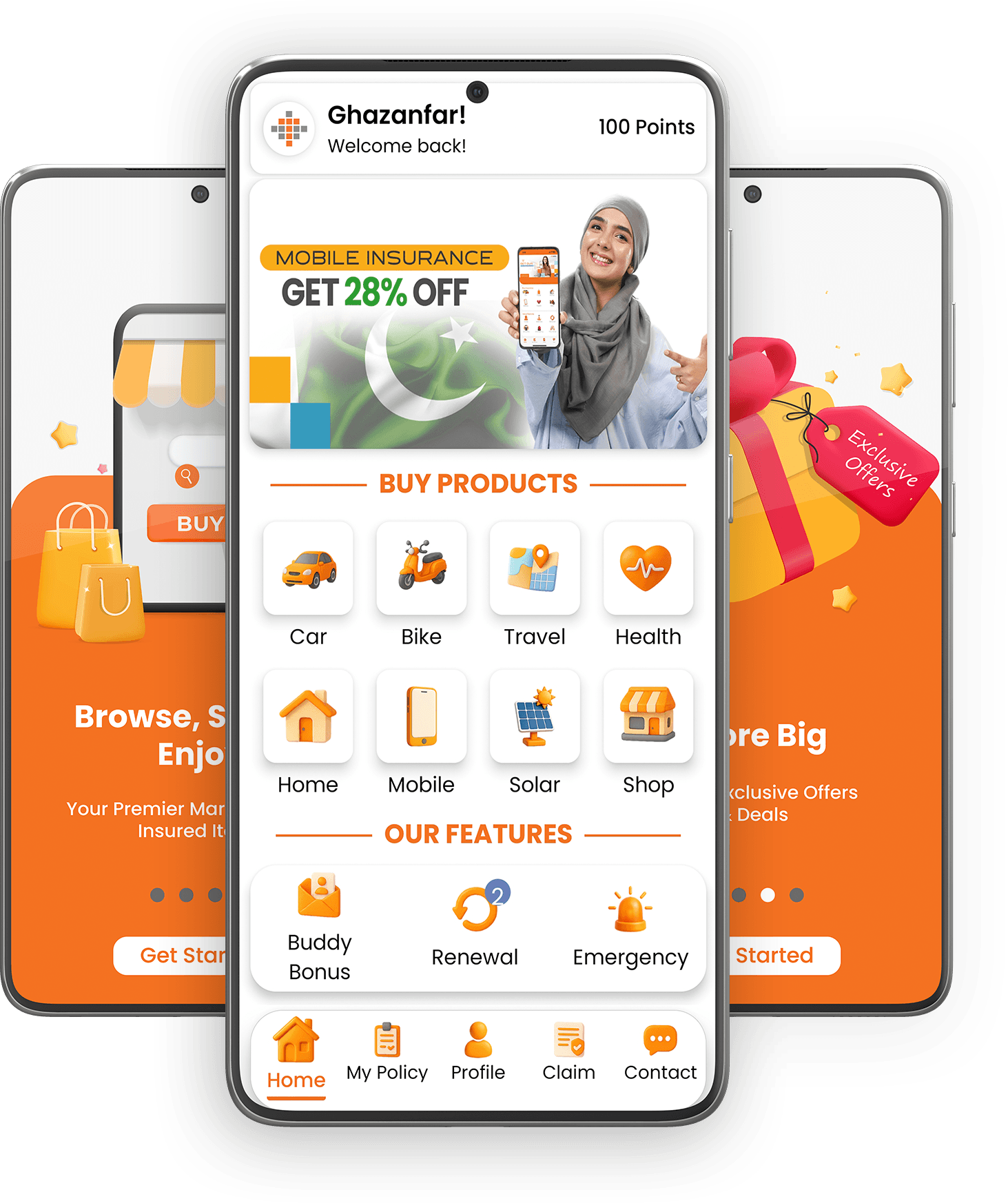

TPL Insurance App

Experience seamless insurance management at your fingertips. With the TPL Insurance App, you can buy and manage policies, make secure premium payments, track claims in real time, and receive instant updates. Enjoy faster support with 24/7 assistance, access exclusive rewards and discounts, and stay in control of all your insurance needs through one smart, intuitive platform.

Frequently Asked Questions

Get answers to common questions about our insurance products.

Our Faq's

Have any questions?

You will not be getting a replacement phone. Instead, a cheque by the Insurance company as per settlement amount.

Subscribe Our Newsletter to

Get More Updates